Venture Capital (VC) provides financing to early stage emerging companies with high growth potential in exchange for equity / an ownership stake. The market is flooded with various funding options, so how should an Entrepreneur approach fund raising?

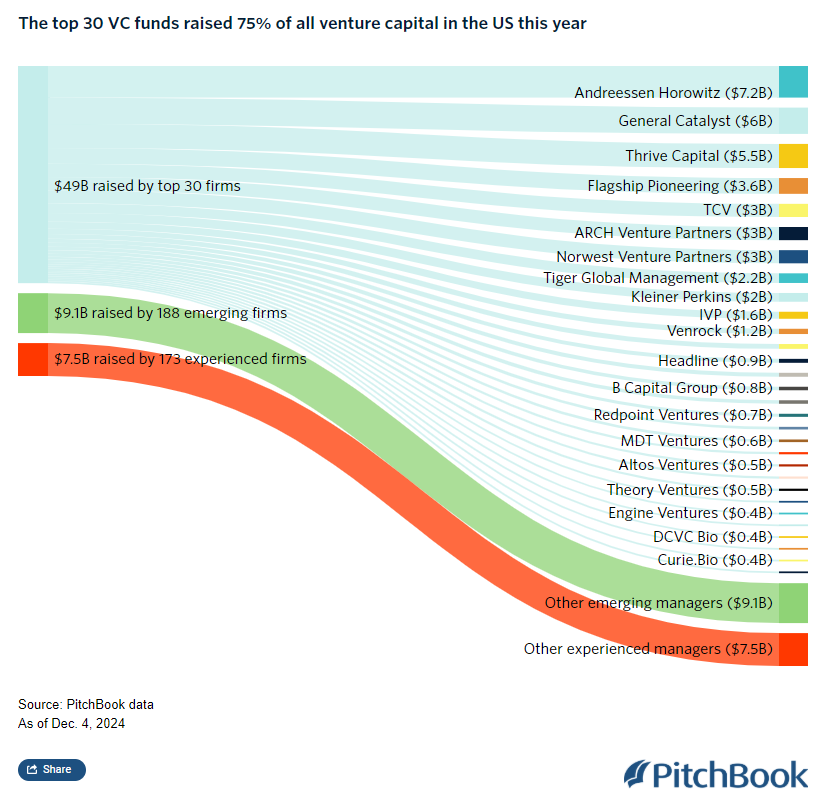

According to Pitchbook in 2024, 30 firms raised 75% of all capital raised by VC funds in the US. If you look at the Forbes Next Billion-Dollar Startups 2024, almost all the startups listed in there are being funded by Branded VCs. However, what are the advantages of working with a branded or non- branded VC?

Working with a branded venture capital fund, one that is well-known, reputable, and established in the industry offers several advantages for startups and entrepreneurs:

Easy Access to Large Pool of Capital

Branded VC funds have deeper pockets, enabling them to invest in multiple funding rounds (Seed, Series A, B, etc.), providing continued financial support a startup needs. They also have the ability to write bigger checks, which is an attractive feature especially if you are in certain capital incentive businesses like AI, etc. Plus a branded VC can easily open doors to other top-tier institutional investors.

Network Effect

Branded VC funds often have solid relationships with industry leaders, potential customers and partners. Entrepreneurs get attracted to this feature as it gives them a foot in the door when it comes to enhancing Sales. Established VCs often have a global footprint, which can help startups expand into new geographic markets with introductions and strategies.

E.g. Accel and other major investors supported Spotify, gained access to industry leaders and strategic relationships that facilitated its entry into multiple geographic markets. Leveraging VC connections, Spotify secured key partnerships with music labels globally, driving its dominance in the US, Europe, and other emerging markets.

Increased Credibility and Validation

Securing investment from a branded VC signals the market that your business has been vetted and validated by a trusted and experienced firm. This can attract other investors, customers, and strategic partners. Being backed by a top-tier VC also differentiates startups from competitors when seeking talent, customers, or additional funding. It positions the company as a leader or innovator in its space.

Expertise

Branded funds usually have experienced partners who provide mentorship, industry insights, and hands-on operational and other advice. They may assist with growth strategies, fundraising, financial planning, and market positioning. If pursuing an IPO, branded VC funds also have the experience guiding companies through the process and strong ties with investment banks. Branded VC firms have a track record of successful exits, such as high-value acquisitions or IPOs. This success enhances confidence from other investors and potential acquirers.

Market Visibility

Startups backed by well-known VC firms often receive increased media coverage, brand recognition, and market trust. This visibility can attract customers, potential hires, and partnerships more quickly.

Competitive Valuation

Believe it or not, VCs often suffer from an emotion – FOMO. This herd behavior drives valuation of certain startups to a new level as their desire to invest in the next "unicorn" and avoid missing out on a potentially massive return opportunity. Startups with a significant buzz, strong teams, or disruptive business models can secure valuations that may exceed typical market metrics.

In summary, working with a branded VC provides more than just capital - it unlocks strategic advantages that can accelerate growth, enhance credibility, and pave the way for long-term success.

Working with a non-branded venture capital fund, a lesser-known or emerging fund, can also offer unique advantages, especially for startups that may not align with the priorities or conditions of established VC firms.

Willingness to Take Risks

Non-branded funds are often more open to investing in unconventional ideas, niche markets, or riskier early-stage businesses that branded VCs may pass on. Some smaller VCs are willing to wait longer for returns, providing startups with time to refine their products and scale sustainably.

Mission Driven

Non-branded funds may align more closely with founders’ long-term visions, offering patient capital and understanding the unique challenges of early-stage startups. They often prioritize building successful businesses over short-term returns.

Easier to Secure Funding

Startups that struggle to gain interest from branded VCs due to industry focus, stage, or traction are more likely to secure investment from a non-branded VC. Lesser-known VCs may be more approachable, with fewer startups vying for their attention and funds.

Flexible Investment Terms

Non-branded VCs may be more willing to negotiate terms such as equity stakes, board seats, or liquidation preferences compared to larger, branded funds. They are often less aggressive in imposing control, allowing founders to retain more decision-making power.

Greater Focus and Attention

Smaller VCs typically manage fewer portfolio companies, meaning they can dedicate more time, attention, and personalized support to each investment. Founders often develop stronger, more collaborative relationships with non-branded VCs, fostering trust and mutual growth.

Opportunity to Build Together

Emerging VCs are often looking to build their reputation and track record. They may work harder to ensure their portfolio companies succeed, as the success of those companies directly contributes to the fund's brand growth. Startups benefit from this extra effort and collaboration.

Entrepreneur Friendly

Non-branded VCs provide flexibility for startups to experiment with unconventional or innovative business models. Further, studies show that approximately 40% of startup founders leave their companies before reaching IPO, sometimes due to board pressures or performance concerns. I personally believe, “if founders can start or build a company, they should be able to scale their business”.

Faster Decisions Making Process

Smaller funds generally have fewer bureaucratic layers, leading to quicker investment decisions and faster access to capital. This agility can be critical for startups that need to move quickly in competitive markets.

Non-branded VC funds can provide flexibility, closer relationships, and greater risk tolerance, making them ideal partners for early-stage, niche, or unconventional startups. They often prioritize personalized support and sustainable growth over rigid expectations and short-term returns, enabling founders to maintain control and align with a partner who believes in their long-term vision.

In the end the decision boils down to who you are, what kind of a startup you have, and if you ultimately want to build your company with the person or the VC sitting on the other side of the table? Yes or No?

Source: Pitchbook, Little Experience, and ChatGPT

Learn more about Ms. Desai at www.nindesai.com

About Ms. Nin Desai:

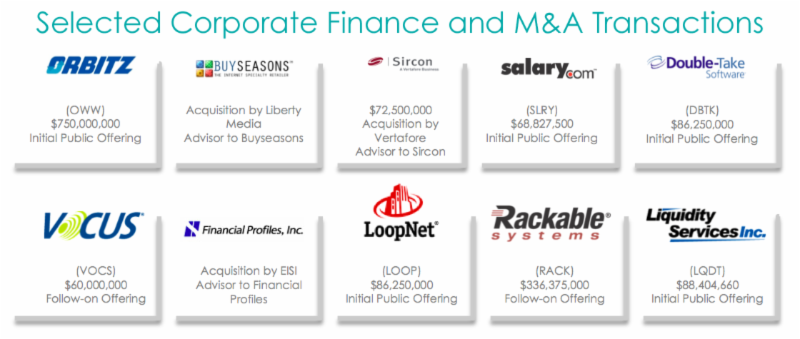

Ms. Nin Desai is an experienced fund manager and a technology geek. Her sweet spot is investing in disruptive technologies. Her experience spans all facets of mergers and acquisitions, and corporate finance including public offerings and private placements from private equity to investment banking and investment management. Her corporate finance transactions include RACK, LOOP, LQDT, DBTK, AMIS, SLRY, VOCS, OWW and others. Her M&A deal sheet includes the sale of Financial Profiles to EISI, Buyseasons to Liberty Media, sale of Sircon to Vertafore, and others. She holds an B.B.A and M.B.A in Finance / International Business from Loyola University of Chicago, and most recently attended leadership program in Private Equity and Venture Capital at Harvard Business School.

Ms. Desai has been awarded 2015 CEO Of The Year – Illinois, for innovation and contribution to the Venture Capital & Private Equity industry by Acquisition International magazine and Private Equity Fund Manager to Watch for 2017 by Corporate America to name a few.

She has been featured in VentureBeat, Chicago Tribune, Chicago Sun Times, Forbes, Inc, WGN's After Hours with Rick Kogan, NBC Weekend Web with Charlie Wojciechowski, Bloomberg's Taking Stock, Crowdfund Insider, and CIO Review to name a few.